Table of contents

When you go on vacation abroad, one of the most important things to consider is how you’re going to change your money into the local currency, or how you’re going to pay for your purchases. While many travelers opt for bureaux de change as a convenient and often one-stop solution, it’s important to note that these establishments can represent a potential risk for travelers.

In this article, we’ll explore 5 reasons why you should avoid changing your money at a bureau de change. By understanding these risks, you’ll be able to make informed decisions and protect your money when you travel, and sometimes even save quite a bit of money in the process – I’ll explain it all to you.

© Can Stock Photo / Deagreez

1. High fees and low exchange rates

One of the main reasons to avoid bureaux de change is the issue of high fees (even though they often display NO FEES) and unadvantageous exchange rates. Bureaux de change often charge high commissions on each transaction, which means you’ll get less local money for each unit of your currency.

What’s more, the exchange rates offered by these establishments can be significantly lower than those on the financial markets, resulting in an additional loss. So it’s best to look for alternatives, such as local banks or ATMs, to obtain more competitive rates and reduce fees.

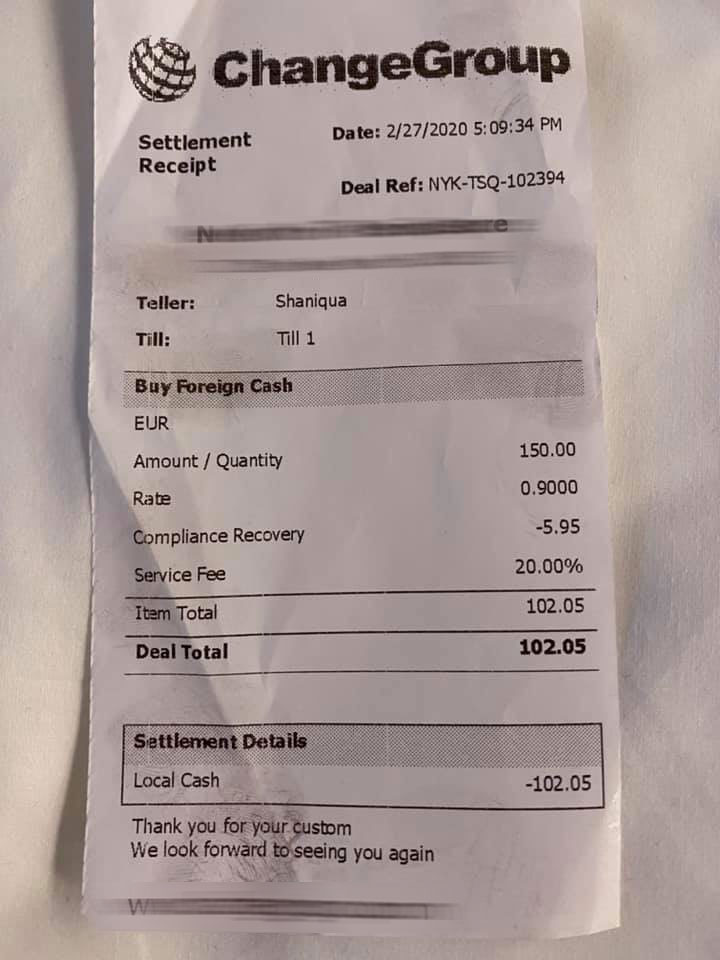

For example, on February 27, 2020, here is the current exchange rate on the markets: €1 EUR = $1.0998 (Source Exchange Rate)

A person has exchanged €150 into US dollars, and should have received $164.97 before fees. Assuming that a withdrawal with your ATM is charged at 5% (which is not possible, it’s usually between 2.5 and 3.5%), this same person would have received $156.72. Here’s the ticket she received and the final amount of the exchange of the $150 into dollars:

The person received $102.05!!! That’s $54.68 in fees! which is just huge!!! To follow the history of exchange rates, visit this site.

2. Fake banknotes

Another risk associated with bureaux de change is the potential for receiving counterfeit bills. Since bureaux de change handle large quantities of cash, it can be more difficult for them to detect all counterfeit bills.

If you end up with counterfeit bills, not only will you lose money, but it can also cause legal problems in some countries. To avoid this potential risk, it is advisable to use reputable financial establishments or ask local residents or travel agencies for advice.

3. Lack of transparency

Currency exchange bureaus can often lack transparency in their operations. They may hide extra charges or use unadvertised exchange rates. This means you could end up paying more than expected, or not getting the exact amount you were expecting.

To avoid these problems, be sure to ask for detailed information on fees and exchange rates before proceeding with a transaction. Also compare the different options available to find the most advantageous solution.

4. Risk of theft or mugging

Exchange offices can attract the attention of thieves and swindlers because of the amount of cash they handle. Going to a bureau de change can increase the risk of being robbed or mugged, especially if you’re carrying a large sum of money. It’s best to limit your cash transactions in my opinion, especially in Paris where tourists are an easy target.

5. Lack of recourse in case of dispute or scam

When you exchange money at a bureau de change, you expose yourself to increased risk in the event of a dispute or scam. Unfortunately, many bureaux de change operate in a poorly regulated sector, which means they can escape any form of official oversight or control. In the event of a problem, it can be extremely difficult to obtain redress or get your money back.

Common bureau de change scams include counting money incorrectly, using counterfeit bills, charging undisclosed fees and manipulating exchange rates. Without proper regulation, it’s difficult to prosecute these dishonest practices and recover lost funds. You could find yourself in a frustrating situation where no one can help you solve the problem.

To avoid these unpleasant situations, I recommend that you look for more reliable alternatives to change your money. Local banks, although they may charge fees, generally offer a better level of transparency and recourse in the event of a problem. ATMs are also an option to consider, as they offer more favorable exchange rates and reduce the risks associated with handling cash. Here again, use bank ATMs and not the ATMs you might find in a bar, supermarket or petrol station, which usually charge an additional fixed fee per withdrawal.

In addition, it’s a good idea to do thorough research before choosing a bureau de change. Check online reviews, ask for recommendations from experienced travelers or locals in the area you’re visiting. Look for reputable, well-established bureaux de change, even if they may be a little further away from tourist areas.

Bureau de change or paying in foreign currency with your bank card: which is cheaper for French people abroad?

When it comes to determining which costs the least for French people abroad, it’s important to compare the fees associated with bureaux de change and bank card payments in foreign currencies. Here are a few things to consider:

Exchange offices

Foreign exchange bureaus can charge high commission fees on each transaction. What’s more, the exchange rates offered may be less advantageous than those available on the financial markets. It is therefore important to compare the different options available and to look for reputable bureaux de change offering competitive fees and reasonable exchange rates.

Credit card payments

When you use your bank card abroad, charges may also apply. Some banks charge a foreign transaction fees, usually a percentage of the amount spent. What’s more, some banks may also apply additional charges for cash withdrawals from foreign ATMs. It’s important to check the terms and conditions of your bank card, and to contact your bank for precise information on charges associated with foreign payments and withdrawals.

Basically, the cheapest method will depend on a number of factors, such as your bank’s fee policy, current exchange rates and the exchange offices available in the country you’re visiting.

Here are a few tips on how to reduce costs when making payments and withdrawals abroad (outside the Euro zone):

Before your trip, ask your bank about the fees associated with payments and withdrawals abroad. Compare the different options available to choose a card with competitive fees. I recommend the Boursorama Ultim card, which offers free payments abroad, 3 free withdrawals per month and a 1.69% fee per withdrawal.

Use your bank card to make payments rather than withdrawing cash every time, as withdrawal fees can add up, especially if you have a limit on free withdrawals.

If you choose to use currency exchange bureaus, look for reputable establishments and compare exchange rates and commission fees to find the best deals.

Avoid exchanging money in tourist areas, where rates and fees may be higher. Instead, look for exchange offices in less touristy areas.

Bottom line

It’s important to remain vigilant when it comes to changing money at a bureau de change. High fees, low exchange rates, the risk of counterfeiting, lack of transparency and lack of recourse in the event of a dispute are all reasons to consider other options for your financial transactions abroad.

Protect yourself by seeking out reliable alternatives and exercising caution in your choices, so you can preserve your finances and enjoy your trip to the full without worrying about potential scams.